Sikoba overcomes the limitations of informal credit:

Proof of transactions

Because debt is registered on a blockchain, users can obtain legal certainty and are able to establish a credit history.

Transactions beyond immediate circle of trust

Users can transact beyond their immediate circle of trust, as SikobaPay identifies trusted intermediaries.

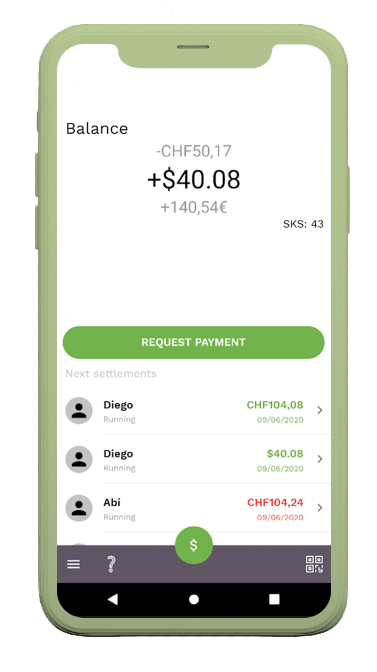

Clearing of circular debts

SikobaPay automatically clears circular debt, thus reducing the need for cash settlement.

Creation of credit history

SikobaPay produces an audit trail, thus it's a first step towards creation of credit history.